Assets the Wealthy Have Always Owned

Sports Assets

Athlete funds, NIL deals, thoroughbreds, and sports franchise interests.

Entertainment

Broadway productions, box office films, and sitcom royalty streams.

Fine Art

Blue-chip and emerging artist works with professional curation.

Real Estate

Trophy commercial and residential properties in prime locations.

Thoroughbreds

Elite racehorses and breeding programs with passion-asset upside.

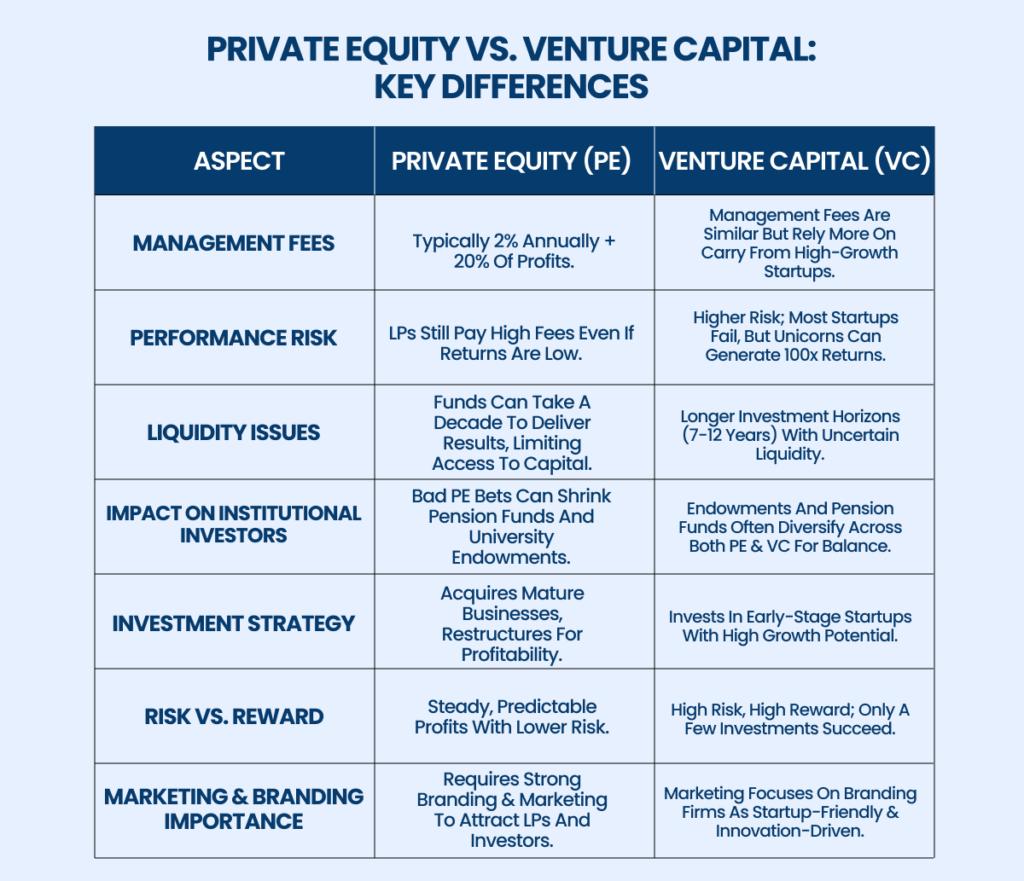

Private Equity & VC

Pre-IPO companies, growth equity, and venture-backed startups.

Collectibles

Classic cars, vintage photography, and rare collectibles.

XP Funds

Multi-strategy funds with principal-first design and Treasury backing.

Why XChange Place

Institutional Access. Individual Flexibility.